When it comes to investing, there is no one-size-fits-all approach. Each person’s situation is unique, so each person’s portfolio should be as well. By diversifying your investment portfolio, you can minimize your risk and maximize your chances of success.

Read on to learn about some unique ways to diversify your investment portfolio.

Invest in NFTs.

You may have heard the term NFT art recently. But what is NFT art meaning? NFTs, or non-fungible tokens, are a great way to diversify your investment portfolio because they are not tied to any one particular company or asset. This makes them much more stable and less risky than other, more traditional investment options. Additionally, the value of NFTs is not as susceptible to market crashes or other economic factors, making them a safer investment choice overall.

Hedge against market downturns with inverse ETFs.

An inverse exchange-traded fund (ETF) is a security that rises in price as the market falls. Inverse ETFs are designed to provide the inverse performance of a particular index, sector, or commodity. For example, if the market falls by 5%, an inverse ETF that tracks the S&P 500 will rise by 5%.

Inverse ETFs are a popular way to hedge against market downturns. By investing in inverse ETFs, investors can limit their losses if the market falls. Inverse ETFs can also be used to generate profits in a down market.

There are a number of inverse ETFs available to investors. Some of the most popular inverse ETFs include the ProShares Short S&P 500 (SH), the ProShares Short Dow 30 (DOG), and the ProShares Short MidCap 400 (MYY).

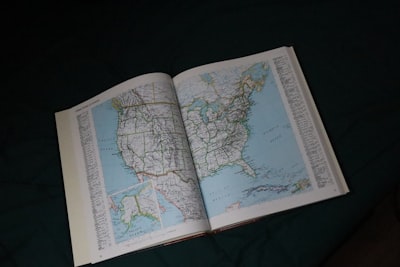

Diversify your portfolio geographically.

When you diversify your investment portfolio, you are spreading your investment dollars among a variety of different asset types. This can be done by investing in different companies in different industries or by investing in different countries.

Diversifying your portfolio geographically is a great way to reduce your risk. If one country’s economy tanks, your investment portfolio will not be as adversely affected as if you had only invested in that country.

There are a number of different ways to diversify your portfolio geographically. You can invest in companies in different countries, you can invest in different regions of the world, or you can invest in different industries in different countries.

No matter how you choose to diversify your portfolio geographically, it is important to do your research first. Make sure you are familiar with the different economies of the countries and regions you are investing in. And be sure to review the financial stability of the companies you are investing in.

Review your portfolio regularly and rebalance as needed.

When you review your portfolio regularly, you are able to see if it is still diversified and if it still meets your goals. If it does not, you can rebalance it. Rebalancing means selling some of the investments that have done well and buying more of the investments that have done poorly. This helps to keep your portfolio aligned with your goals.

Diversify your portfolio by company size.

When it comes to diversifying your investment portfolio, there are a variety of ways to do so. One option is to focus on company size. This means investing in both small and large companies, in order to spread your risk and maximize your potential for returns.

There are a few reasons why this is a smart strategy. First, small companies are riskier investments, but they also have the potential for higher returns. By investing in both small and large companies, you can minimize your risk while still having the opportunity to reap the benefits of high-growth businesses.

Second, company size is not a static characteristic. Over time, small companies can grow into large ones, and vice versa. By investing in a mix of small and large companies, you ensure that you are always taking advantage of changing market conditions.

Invest in alcoholic brands.

When most people think about investing, they think about stocks, bonds, and mutual funds. However, there are a variety of other options available, and one of these is alcoholic beverages. There are a number of different alcoholic brands that can be used to diversify your investment portfolio, and each has its own unique benefits.

One option is to invest in a brand that is growing in popularity. For example, the craft beer industry is booming, and there are a number of different craft beer brands that could be used to diversify your investment portfolio. These brands are typically smaller, and they are often located in specific regions. This can be a good option if you are looking for a brand that is likely to have strong growth potential.

Overall, there are a variety of reasons why it is important to diversify your investment portfolio. By investing in a variety of different asset classes, you can help reduce your risk of experiencing a large loss if one of your investments performs poorly. Additionally, diversifying your portfolio can help you achieve your financial goals by providing exposure to a variety of different investment opportunities. By investing in a mix of stocks, bonds, and other asset classes, you can help minimize the impact of any single investment on your overall wealth.